Since completing the acquisition of the Selkirk Mine in August 2022, NEXM has been focused on de-risking the project to support future development decisions.

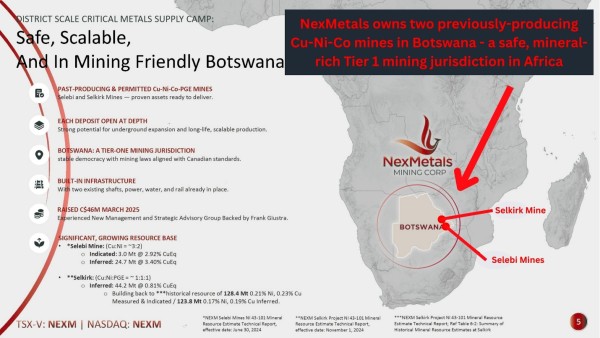

Vancouver, BC, September 25, 2025 – Global Stocks News – Sponsored content disseminated on behalf of NexMetals Mining. On September 23, 2025, NexMetals Mining (TSXV: NEXM) (NASDAQ: NEXM) released assay results from two additional holes in the 12-hole metallurgical drilling program at the Selkirk Mine in Botswana.

Selkirk is a past-producing copper-nickel-cobalt-platinum group elements (Cu-Ni-Co-PGE) mine in Botswana. It is situated 28 kilometers south-east of the city of Francistown (pop. 103,000), and 75 kilometers north of NexMetals’ Selebi Mines.

Since completing the acquisition of the Selkirk Mine in August 2022, NEXM has been focused on de-risking the project to support future development decisions.

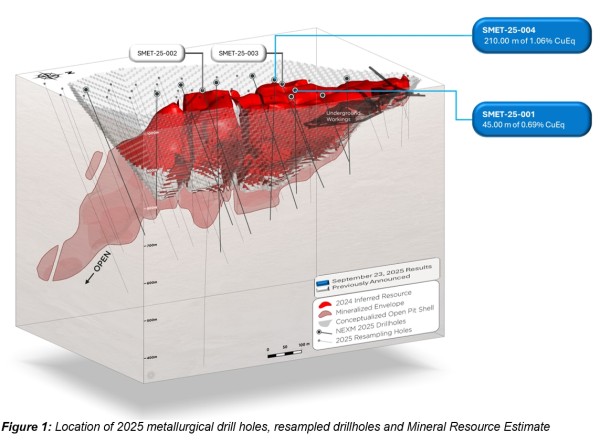

The 12-hole drill program wrapped up in August and was focused on collecting samples for metallurgical testing, validating legacy data and adding key data points to support a future resource model update.

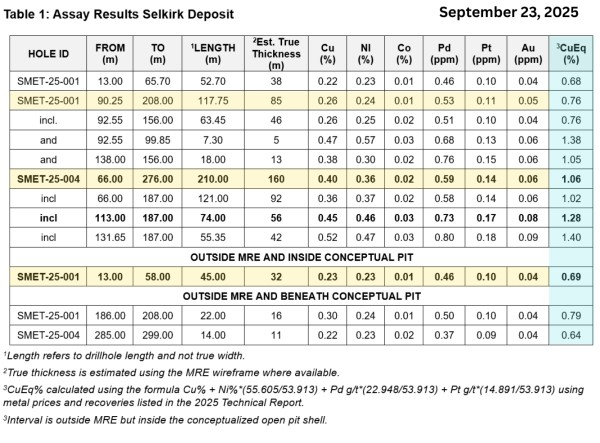

SMET-25-004 returned a wide interval of continuous mineralization: 210.00 metres of 1.06% CuEq (0.40% Cu, 0.36% Ni, 0.59 ppm Pd, 0.14 ppm Pt)

incl. 74.00 metres of 1.28% CuEq (0.45% Cu, 0.46% Ni, 0.73 ppm Pd, 0.17 ppm Pt).

Mineralization outside the Mineral Resource Estimate (MRE) and within the current conceptual pit shell demonstrated the potential for expansion of the deposit toward the surface: SMET-25-001: starting at 13.00 metres from surface, 45.00 metres of 0.69% CuEq (0.23% Cu, 0.23% Ni, 0.46 ppm Pd, 0.10 ppm Pt).

The current cut-off of US$25.00 per tonne net smelter return defined in the MRE translates to 0.46% CuEq. Any material above this cut-off grade could be potentially mined.

“The results today, combined with last week’s news of drill hole 003, highlight multiple intercepts over 200 metres of high-grade mineralization, once again exceeding our expectations at Selkirk,” stated NEXM CEO Morgan Lekstrom.

“These results position Selkirk as a standout asset, reinforcing the substantial scale of the deposit. Exceptionally notable are drill holes 003 and 004, as they show very similar grades despite being more than 125 metres apart.”

“This further emphasizes both the size, consistency, and presence of broad intervals of higher grades within this deposit,” continued Lekstrom. “Upcoming catalysts include resource expansion, metallurgical results and optimization, rapidly unlocking the full value and long-term potential of the Selkirk mine.”

Large widths of near-surface mineralization support open-pit development potential with a low strip ratio.

The technical report revealed Inferred Mineral Resources of 44.2 million tonnes at 0.30% copper, 0.24% nickel, 0.55 g/t Pd, and 0.12 g/t Pt, containing 132,000 tonnes of copper, 108,000 tonnes of nickel, 775,000 ounces of palladium and 174,000 ounces of platinum.[1]

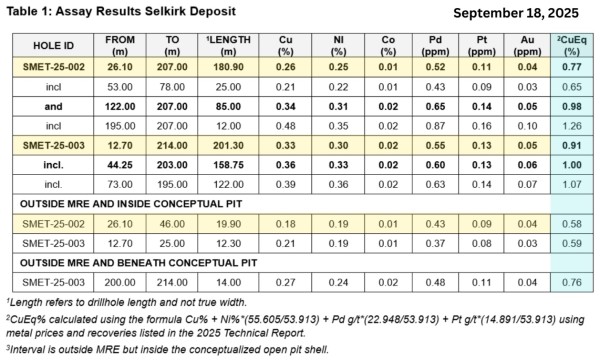

Five days earlier, on September 18, 2025 NEXM released the assay results from the first 2 holes of the 12-hole metallurgical drilling program at Selkirk.

These results also demonstrate the scale and consistency of mineralization: 201.30 metres of 0.91% CuEq (0.33% Cu, 0.30% Ni, 0.55 ppm Pd, 0.13 ppm Pt); 85.00 metres of 0.98% CuEq (0.34% Cu, 0.31% Ni, 0.65 ppm Pd, 0.14 ppm Pt). Starting at 26.10 metres from surface, the drill hit 19.90 metres of 0.58% CuEq (0.18% Cu, 0.19% Ni, 0.43 ppm Pd, 0.09 ppm Pt).

“Combined with the ongoing resampling and metallurgical programs, these results not only provide essential material for processing studies but also indicate meaningful opportunities to improve the strip ratio,” stated Lekstrom.

“Selkirk continues to demonstrate substantial upside, and with our dual focus on metallurgical optimization and resource growth, we are increasingly defining the full scale and potential of this deposit.”

For the last decade, diamonds have accounted for around 80% of Botswana’s exports, one-third of fiscal revenues, and one-quarter of GDP. Botswana is the world’s largest diamond producer by value.

“The market for natural diamonds is in crisis, with cut-price lab-grown equivalents hitting demand particularly hard in the U.S.,” confirms Japan Times (JT) on September 4, 2025.

“Botswana is accelerating efforts to secure control of De Beers as parent company Anglo American moves forward with plans to divest its 85% stake in the diamond giant,” reported Mining.com on September 23, 2025.

![]() Botswana’s plan to buy De Beers may involve financing from Oman’s sovereign wealth fund. While negotiations continue, Boko has been vocal about his intention to diversify into non-diamond commodities.

Botswana’s plan to buy De Beers may involve financing from Oman’s sovereign wealth fund. While negotiations continue, Boko has been vocal about his intention to diversify into non-diamond commodities.

“Copper production provides the most immediate source of economic diversification,” notes Lyle Begbie, an economist at Oxford Economics Africa.

“I’ve had the privilege of meeting the new President Duma Boko,” Lekstrom told GSN. “He is a Harvard Law School graduate, a passionate politician and a sharp businessman.” We believe the Selebi and Selkirk copper-nickel projects can play a positive role in Botswana’s next economic evolution.”

Recent interest in the Selebi and Selkirk Mines has been catalysed by a surge in demand for critical metals required for the green energy transformation (Solar, EVs). In the last five years, as demand drivers intensify, the price of copper has increased 92% – from USD $2.36/lb to $4.50/lb.

The September 23, 2025 assay results bring the total number of metallurgical drill holes announced from the 2025 program to four, with further assays to be released on an ongoing basis.

[1]The mineral resource estimate on the Selebi Mine is supported by the technical report entitled “Technical Report, Selebi Mines, Central District, Republic of Botswana” and dated September 20, 2024 (with an effective date of June 30, 2024) (the “Selebi Technical Report“), and prepared by SLR Consulting (Canada) Ltd. for NEXM. Reference should be made to the full text of the Selebi Technical Report, which was prepared in accordance with NI 43-101 and Subpart 1300 of Regulation S-K and is available on SEDAR+ (www.sedarplus.ca) and EDGAR (www.sec.gov), in each case, under NEXM’s issuer profile.

All scientific and technical information in this news release has been reviewed and approved by Sharon Taylor, VP Exploration of the Company, MSc, P.Geo, and a “qualified person” for the purposes of National Instrument 43-101 and Subpart 1300 of Regulation S-K.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: NexMetals Mining paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as “project,” “anticipate,” and “target,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country:Canada

Release id:34426

The post NexMetals Hits Multiple 200-Meter Intercepts of High-Grade Mineralization at the Selkirk Project in Botswana appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Opinion Bulletin journalist was involved in the writing and production of this article.