Dubai, UAE – 14/07/2025 – (SeaPRwire) – BlockBits, crypto futures trading platform, launch a new tool for advanced futures trading for higher potential returns with up to 200x leverage.

As cryptocurrency markets mature and price swings become more extreme, active traders are increasingly turning to risk management strategies once reserved for traditional finance. One strategy gaining notable traction is hedging – protecting open positions by opening an opposing trade to balance potential losses.

Unlike in stocks or commodities, hedging in crypto has only recently become practical for a wider range of traders. With the expansion of futures and perpetual contracts, traders can now offset price movements without selling or transferring their core holdings – a key advantage for long-term investors facing short-term market uncertainty.

“For example, a trader holding a major crypto asset can hedge against sudden volatility by opening a short futures position. If the asset’s price drops, gains from the short can help offset losses on the original holding – providing greater peace of mind in unpredictable conditions”, – said in company.

Recognizing this growing need, several crypto exchanges are now integrating built-in hedging tools. Features such as the ability to hold both long and short positions on the same pair within a single account are making once-complex strategies more accessible. This is especially important for traders using high leverage or delta-neutral approaches, where profits and losses on opposite positions can balance each other out.

Such tools also reduce trading costs by avoiding the need to close and reopen positions repeatedly – a process that can rack up fees and slippage in fast-moving markets. A smoother, single-interface experience means traders can react faster to market shifts without interrupting their broader investment plans.

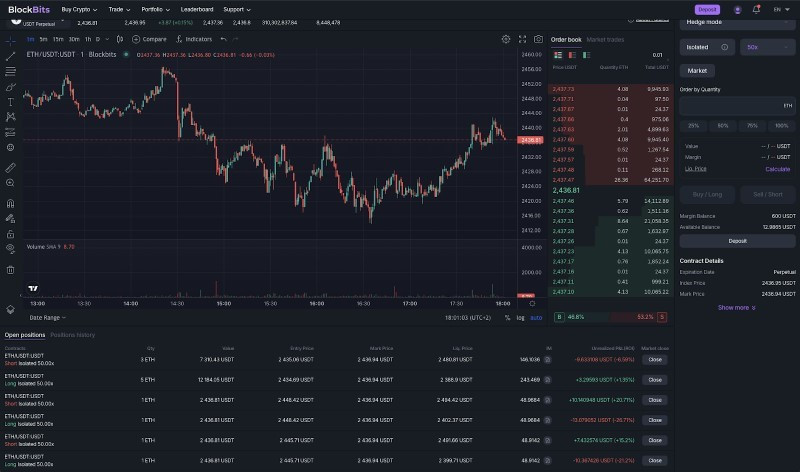

One platform at the forefront of this trend is BlockBits, which has designed its trading environment specifically with hedging in mind. Users can open long and short positions simultaneously on the same pair, track risk and margin separately, and monitor real-time profit/loss and liquidation levels across both sides. In a recent example with the ETH/USDT pair, BlockBits traders were able to hold dual up to 200× leverage positions – a feature not always offered by other exchanges.

By integrating hedging into the core trading interface, platforms like BlockBits are helping crypto derivatives mature – providing tools that cater to both aggressive trading and robust risk management. As more traders seek to balance exposure without sacrificing opportunity, such innovations are set to become a standard part of the crypto futures landscape.

Contact information

Brand: BlockBits

Contact: Media team

E-mail: info@blockbitstech.com

Website: https://blockbitstech.com/en

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Opinion Bulletin journalist was involved in the writing and production of this article.